Large single-aisle aircraft have enjoyed very strong sales success, with commitments running considerably higher than their predecessors achieved at the same stage of introduction. The combined backlog for the A320 and 737 stands at a huge 10,500+ aircraft. Neither Airbus nor Boeing has many available slots through 2022.

To some extent, some airlines still focused on a market-share driven strategy derive their strength from large single-aisle aircraft fleets and low unit costs. Those carriers have been the engines of this impressive commercial performance. While competition demands constant emphasis on cost leadership and productivity improvements, I maintain that this model is necessary but insufficient. Resilient strategies and a more nuanced competitive positioning will be increasingly important.

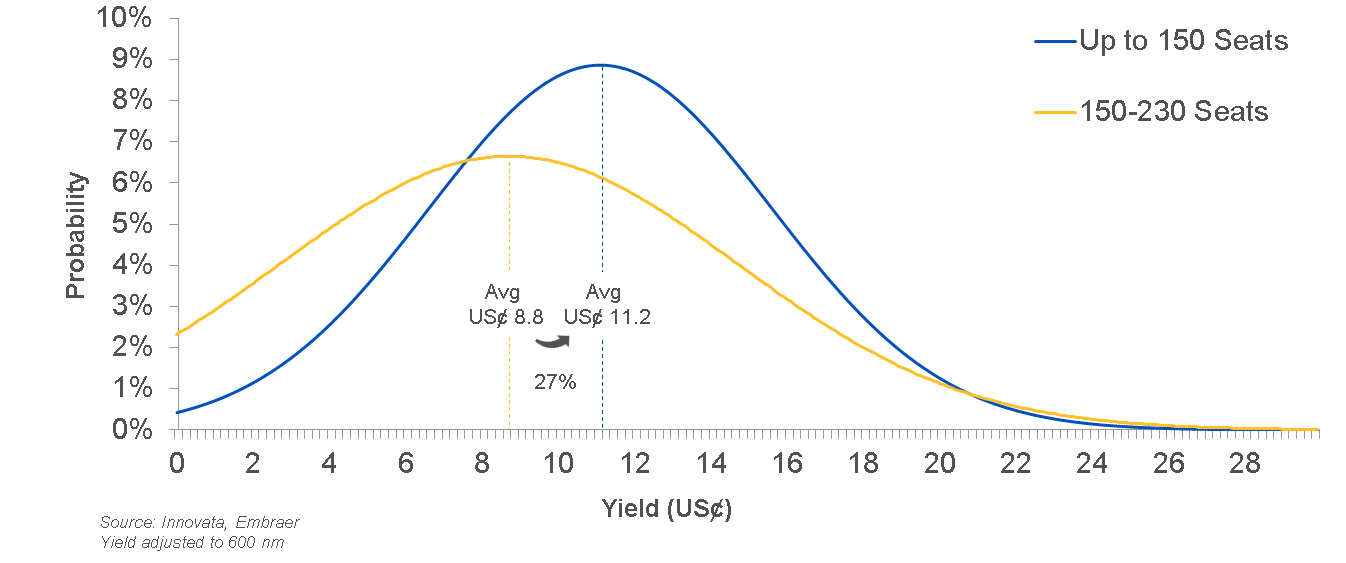

The future economic performance of the industry will mostly depend not only on how far costs will rise, but also to what extent airlines can sustain a healthy revenue environment. Greater control in matching aircraft capacity to market demand results in a greater percentage of higher-fare passengers. That, in turn, increases both yields and load factors.

A right-sized aircraft can induce revenue management systems to better accommodate demand variations and maximize yield. As shown in the chart below, aircraft with up to 150 seats usually command higher yields, USȼ 11.2 on average — 27% higher than large single-aisle aircraft.

Within the structurally changing environment, I see a new strategic mindset influencing fleet decisions. Right-sized aircraft are forming an ever more integral part of the global air transport eco system.

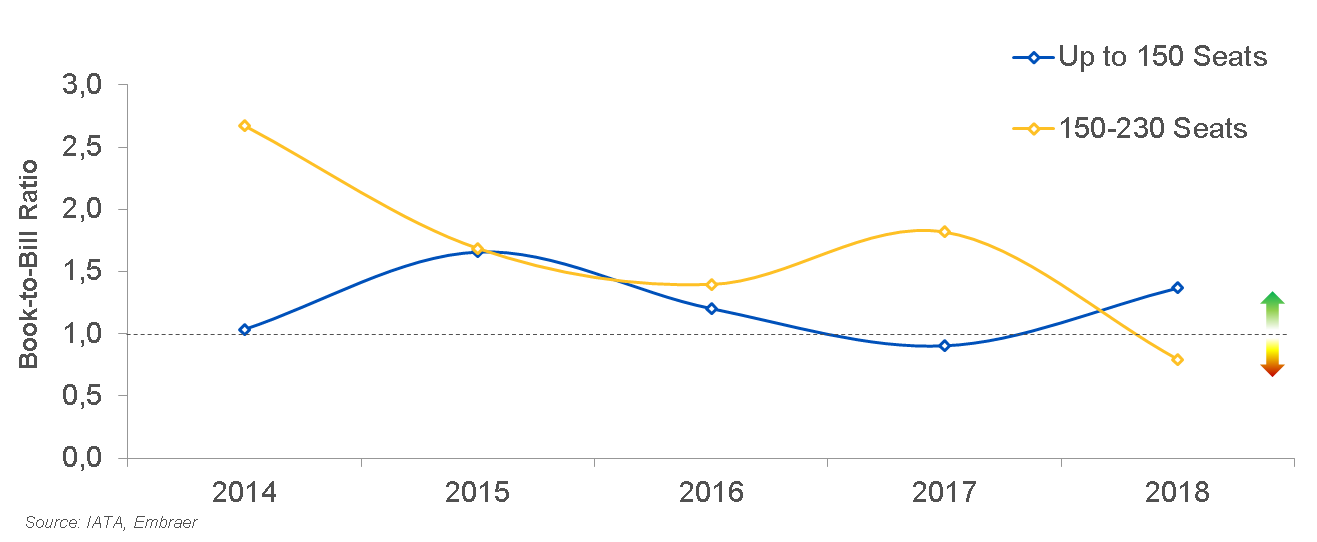

For the first time in this decade, the book-to-bill ratio of large narrow-body aircraft is currently under one to one. That number must continue in the few next years in order to avoid a glut in capacity.

The single-aisle sector is undergoing a metamorphosis, or an evolution since it has shown its inefficiency in deploying larger aircraft like the A320 and the A321 or larger 737s that have more seats than can be profitably filled. 2018 has been a major turning point – we’re seeing growing relevance of right-sized aircraft in better matching capacity to market demand as business cycles fluctuate. The book-to-bill ratio of aircraft with up to 150 seats is now running at 1.4 with orders gradually rising compared to other seat segments.

The leasing sector should follow suit.

Rising competition is a major issue for lessors. New entrants are coming into the space with lower cost of funds, which is being blamed for pushing down lease rate factors considerably. The new entrants have been criticized for driving down lease rate factors of large narrow-body aircraft. This is particularly evident in the sale-leaseback market in recent years as they build market share, seemingly at any cost. The race to the bottom in buying deals resulted in lease rate factors reported to be lower than 0.6.

As things stand and in the direction the market is moving, values of up to 150 seat aircraft ought to increase given that: 1-the importance of our segment is now undeniable, as Airbus and Boeing are showing; 2- the general trend to less competition in each segment due to fewer product offerings, which when coupled with growing demand, bodes well for values. The market has fewer aircraft (and OEMs) to choose from than in the past.

And there is one more reason on the horizon for airlines and lessors to review their fleet strategies. Fuel and labor costs continue to go up. That’s affecting profitability and reinforcing the need to look at alternatives to improve revenue. Also, we must always remember that our industry is inherently cyclical. The current cycle is already extended and shocks are, by definition, unexpected.

Whether there is something to brag about in the upcoming years will depend upon how seriously the airline industry responds to the threats. The need to right-size with aircraft able to weather any cycles in demand and supply becomes all the more imperative.

Notwithstanding the arguments over the shape of this particular cycle, the airline industry remains a cyclical business.

The question is when, not if, the downturn will impact the industry’s fortunes.

So, when demand eventually softens, the hit will be felt mostly on airlines and lessors that rely solely on large NBs. What’s my solution for prospering in an ever more complex landscape? Adaptability.