by Vagner Ricardo – Airline Strategy Director – Americas

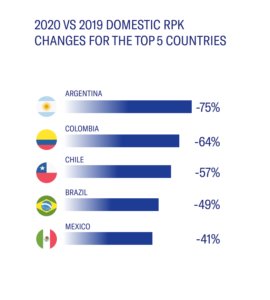

I don’t have to remind you how bad things are in the industry. We all see the statistics. Despite the region’s volatile economies, currency depreciation, and high fuel prices, demand for air travel in 2020 was slightly better than the world average. Compared to 2019, Latin America’s RPKs were down 59% vs. a 64% global decline.

Since international border restrictions are responsible for the majority of the drop, countries with domestic airline networks can maintain some semblance of service. Performance, however, is mixed.

Argentina was hit hard. All flights were grounded until last October. Even today, carriers must seek regulatory approval to resume flying, which is still prohibited in some parts of the country.

Airlines in Colombia restarted service in September. RPKs are recovering, but slowly.

RPKs in Brazil and Mexico declined nearly 90% in April, the lowest levels of any month in 2020. Their domestic markets are now recovering faster than expected.

Recovery, however, is coming at a cost. Carriers have slashed fares to encourage people to fly and fill seats. 2020 domestic yields fell 23% in Brazil and more than 30% in Mexico compared to 2019.

Aircraft size accounts for some of that decline. Latin American airlines have airplanes that are simply too big for small and medium-sized markets. And when there is a further shock to the system, like a pandemic-led downturn, they slash fares to attract passengers and generate cash. Yields and profitability always suffer.

So, What’s Next?

The speed with which international borders reopen depends on how effective governments will be in reducing the infection rate. Given the emergence of new C19 variants, Latin America’s RPK recovery will be slow.

I see three structural things shaping air travel in the medium to long-term:

Technology

It’s now easier than ever to conduct business from home – or any place other than the traditional office, thanks to advances in communication technology, which will impact high-fare business travel for a longer period.

Decentralization

Demand won’t be concentrated in big cities. Expect wider distribution and more demand from secondary cities or secondary airports in large metropolitan areas. That will, in turn, increase the need for smaller-gauge aircraft.

Infrastructure

Decentralization will require investment in infrastructure and Latin America needs more. The government of Colombia is leading the pack with its tourism development strategy to attract foreign visitors. Brazil privatized 22 airports and is targeting 44 more over the next two years. The good news is that airlines are talking to airports and investors to find ways to open new routes and drum up new business.

Latin American carriers, like others around the world, are rethinking their old business models, networks, and one-size-fits-all fleets. Their focus is now on profitability and cash flow, not market share.

The key to survival is flexibility. It starts with having the right airplanes on the right routes.