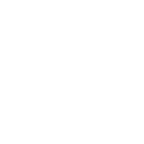

In its recent report, IATA Americas Focus presents an upward trend air travel in Latin America in the first half of 2017:

“At the regional level, the pace of RPK growth also recovered to a brisk 7.8% YOY for Latin American carriers. RPK growth in the domestic Brazil market returned to positive territory (+5.9% YOY) in March – the first time since July 2015.”

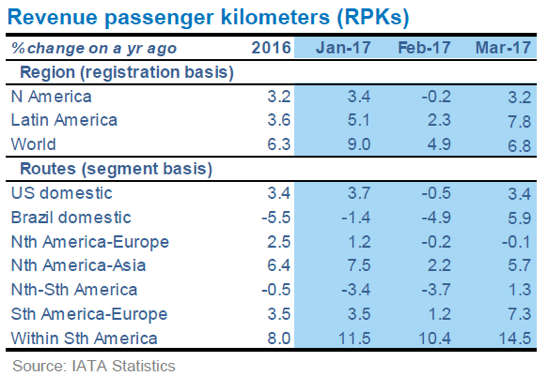

Also, according to IHS Markit, “business confidence in Brazil moved above 50 for the first time since January 2015. Renewed political turmoil may mean this gain is short-lived. Confidence eased modestly in both Mexico & the USA this month.”

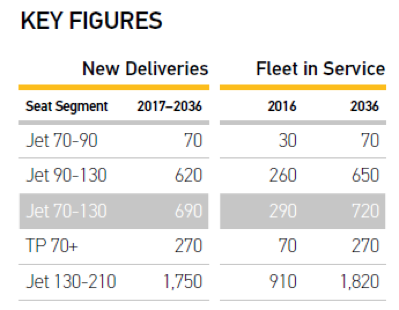

These positive trends are consistent with those presented in Embraer’s 2017 Market Outlook.

According to the publication, after a decade of sustained economic growth in many countries in Latin America, economic output was negative in 2016 for the second consecutive year. Still, the region is at a turning point and gaining traction with economic turnaround and per capita income growth projected to start in 2017. However, this catch-up will be at modest growth rates in the short-term reaching 1.3% in 2017, 2.2% in 2018, and accelerating to 2.8% over the next 20 years.

Growth opportunity

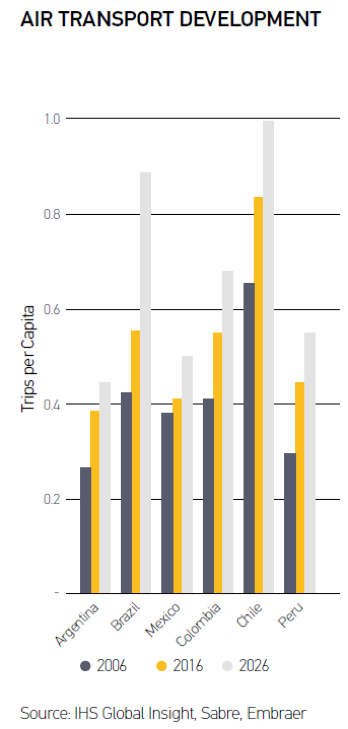

Propensity to travel, measured by the economic output per capita of each country, is an indicator of such opportunity. Comparing the region with a mature air travel market like the USA reveals enormous potential for growth: Latin America has 0.5 airline passengers per capita, a figure that is one fifth that of the USA.

The case for right-sizing

A mix of large and small narrow-body jets gives airlines more flexibility to respond to a dynamic market environment. Right-sized aircraft, such as the E-Jets family, have been allowing Latin American carriers to offer a better combination of capacity and frequency, maintain service quality, and expand their networks with lower-density markets. Smaller-capacity aircraft are fundamental to gradually improving overall regional air travel connectivity in the region.

Azul Brazilian Airlines, for example, found that acquiring E-Jets was the solution for its goal of greater profitability. It could offer more frequencies than its competitors and more flexible schedules to attract high-yield customers.

In Latin America, Copa Airlines and AeroMexico have adopted a similar strategy.

Read the complete Embraer Market Outlook at www.embraermarketoutlook2017.com