Last week, I was discussing details of IATA’s latest Airlines Financial Monitor report with some of my team. Its Q4 2016 analysis indicates that the world’s airlines are entering a period of declining profitability even though their share prices are up nearly 7% year-over-year. Despite Warren Buffett’s recent recommendation to buy airline stocks, they still lag behind the annual growth average for global equities.

As we move into 2017, the airline industry will need to consider some restraints when it comes to capacity additions. Otherwise, aggressive capacity expansion is bound to adversely impact even further the industry’s earnings.

Yields, measured by US ¢ per revenue passenger kilometer (RPK), are trending down as a result of a massive capacity inflow in the system and the need to stimulate traffic and populate the ever-expanding fleets.

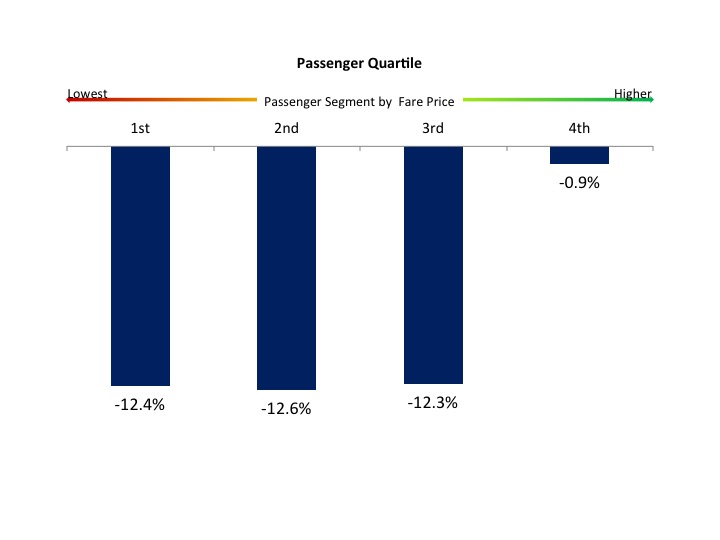

Segmenting passengers in groups of 25% (quartile) ranked by fare prices, it is clear that premium air fares continue to generally hold up, but downward pressure on economy cabin remains substantial. While low-fare passengers are paying on average 12% lower fares, airline’s revenue have been underpinned by the top quartile. Those 25% of total passengers who paid the highest fares had just a slight reduction compared to the 2015 levels, supporting more than half of an airline’s profit.

The chart below shows the yield reduction (2016 x 2015) in intra-regional flights by passenger quartile, according to Sabre Market Intelligence and Embraer estimates.

The over-reliance on large aircraft translates in inefficiencies that, in turn, lead to tumbling yields.

So under these circumstances does it make sense to keep adding capacity to the systems with airplanes that are too big? The additional seats offered by larger aircraft focus on the more profitable premium passengers or the heavily discounted economy seats? If we take a look at regional differences we may have a hint whether aircraft size has an effect on airlines profitability.

Of course getting the balance of seats, frequencies and prices just right isn’t easy. And it’s even harder in high-volume, low-fare, cut-throat environments. But excess capacity from airplanes that are too big are usually offered with heavy discounted to stimulate demand or grab market share from a competitor. This is a familiar story. Cost-cutting can take you only so far but it seems there is no limit to reducing ticket prices to fill all the empty real estate in the economy cabin. Just how low can you go? Razor-thin margins are often the result of market share-driven strategies. Having worked in the financial world for most of my life, it always amazes me to see how the airline industry earns such a poor return on invested capital.

IATA’s profitability trend analysis seems to confirm what we’ve been saying all along – smaller-capacity aircraft, deployed on the right routes, have a better mix of high and low fares that routinely generate higher revenue per seat. That, combined with lower trip cost, can really drive up margins and profits.

Average yield, load factor, CASM/CASK, RASM/RASK, RPMs/RPKs, ASMs/ASKs – these are the classic indicators airlines use to measure operational and financial performance. But you rarely see much emphasis on margin and asset return. It’s why we’ve been focused on promoting sustainable profitability and maximizing return on invested capital when we visit prospective customers. It all starts with capacity discipline.

It’s tough to change the mindset of airlines, especially those that look short term and play the market share game. Although IATA is forecasting the price of jet fuel to remain relatively flat this year, the slightest spike may be enough to push industry profits down hard.

And no one likes a hard landing.