The “soft underbelly” is a reference to what Winston Churchill described Italy as during WW2, when the Allies were choosing from where to invade Nazi-occupied Europe in 1943. What he was clearly seeking was the Achilles Heel; a kink in the armour of the Axis Powers, where they would have weaker defences. The success of this strategy in WW2 meant that Italy was disabled and Germany weakened by the time the Allies invaded France in 1944. The rest is history.

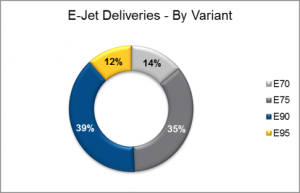

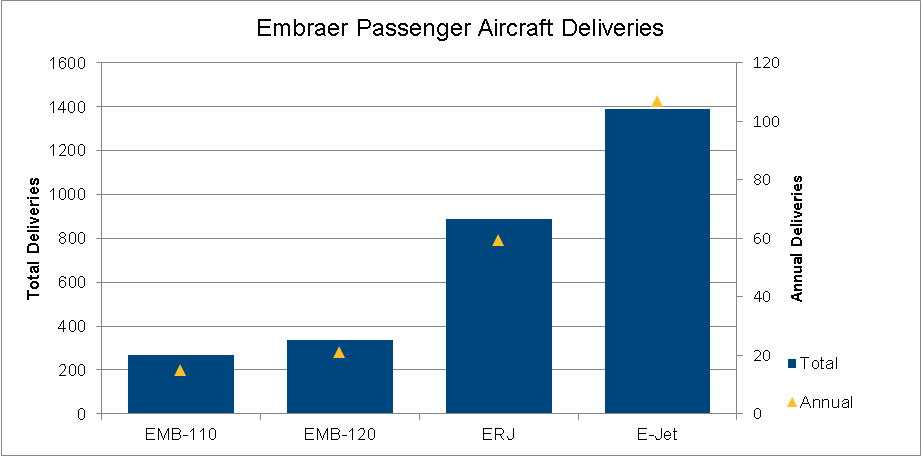

Embraer too has new battlefronts opening up. We have already delivered 1,400 E-Jets, which in itself is a significant milestone. Not only because we have been delivering on average some 100 a year since EIS in 2004, but also since 1,400 is approximately the number of A319s produced by Airbus. In fact, it was Airbus’s 2nd most widely produced narrowbody until overtaken by the A321 in 2016, despite the latter entering service over two years earlier.

1400 E-Jets Deliveries – American Envoy

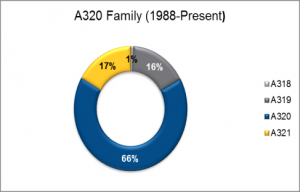

1,400 is also a big number for Boeing, especially when considering that for all the guises in which the venerable 737 has appeared, only the -800 series has exceeded this number of deliveries. The -700 in fact has seen over twice the number of deliveries as the -900ER.

There is therefore something of a dissonance between the successes of the A319 and 737-700 versus the narrative from their respective OEMs. It is true that both production lines will soon close (after more than 20 years), and that their next generation successors are courting about as much interest as the famously niche A318 and 737-600. It is also true that, in spite of the hammer blows dealt to the economics of the A319 and 737-700 by high oil prices in 2008-14, some 95% remain in service. Indeed, United and Southwest are still acquiring mid-life, pre-owned examples in bulk, and they are not alone.

What is the significance of this to Embraer? Simple: the A319 and 737-700 markets remain to the day a massive addressable market, yet one neglected for many years by Airbus and Boeing as they fought battles on other fronts. When considering that both around 95% of all these aircraft delivered remain in service, we are talking some 2,500 aircraft that will need replacement. Of course there is considerable pressure for most of these operators to simplify the lives of the OEMs, lessors and finance communities alike, and concentrate orders for next generation on only largely variants – by some mystery considered to be naturally more “liquid” – than to actually continue meeting true demand.

This is where we as Embraer step in. We build families of aircraft that offer flexibility, versatility and resilience to the cycles inherent in aviation. Our aim is not to leave it to our customers to figure out how to fill aircraft too large for their networks, or to encourage them to do so by dropping yields, but to actually provide as close a match in capacity as there is in organic demand.

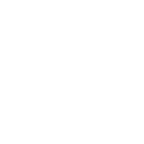

The legacy of the E-Jet-E1 family is exactly that: we built four different variants – all of which comfortably achieved triple-digit sales – for different missions and different markets. And the numbers speak for themselves: it is the most balanced four-variant family of jets (each variant signifying a fuselage gauge) ever produced. In metaphorical terms, we build “horses for courses”.

The E2 will continue this tradition. Specifically the E195-E2, as the most radically different design, holds within it the potential to unlock the largest addressable market Embraer has ever faced. And here there is an intellectual oversight in the consensus about air traffic doubling every 15-20 years: we are in agreement with the statement in itself, but that growth in and of itself does not warrant mass-migration towards large narrowbody aircraft. Within that growth, markets which today are too small for E-Jets will start appearing on our radar, while markets operated today by our smaller E-Jet variants will naturally evolve into our larger variants. The same occurred with every family of aircraft we have built:

Last but not least, there is another trend that as Embraer we embrace: the growth in point-to-point (P2P) markets. Our E-Jets have already proven themselves as excellent hub-feeders for major airlines around the world, scheduled in conjunction with narrowbodies and often replacing them with additional frequencies. But P2P is a facet more unique to the E-Jet, since to be able to offer a decent level of service – say, >3 weekly frequencies – a larger narrowbody simply makes no sense. In addition, with demand for widebody aircraft now coalescing in the 250-300-seat segment, and the next generation of narrowbody aircraft serving many of the thinner long-haul routes, the E2 can also work as a feeder in a different way: building traffic flows through secondary and tertiary city pairs to fill the larger aircraft before they “hop the pond”.

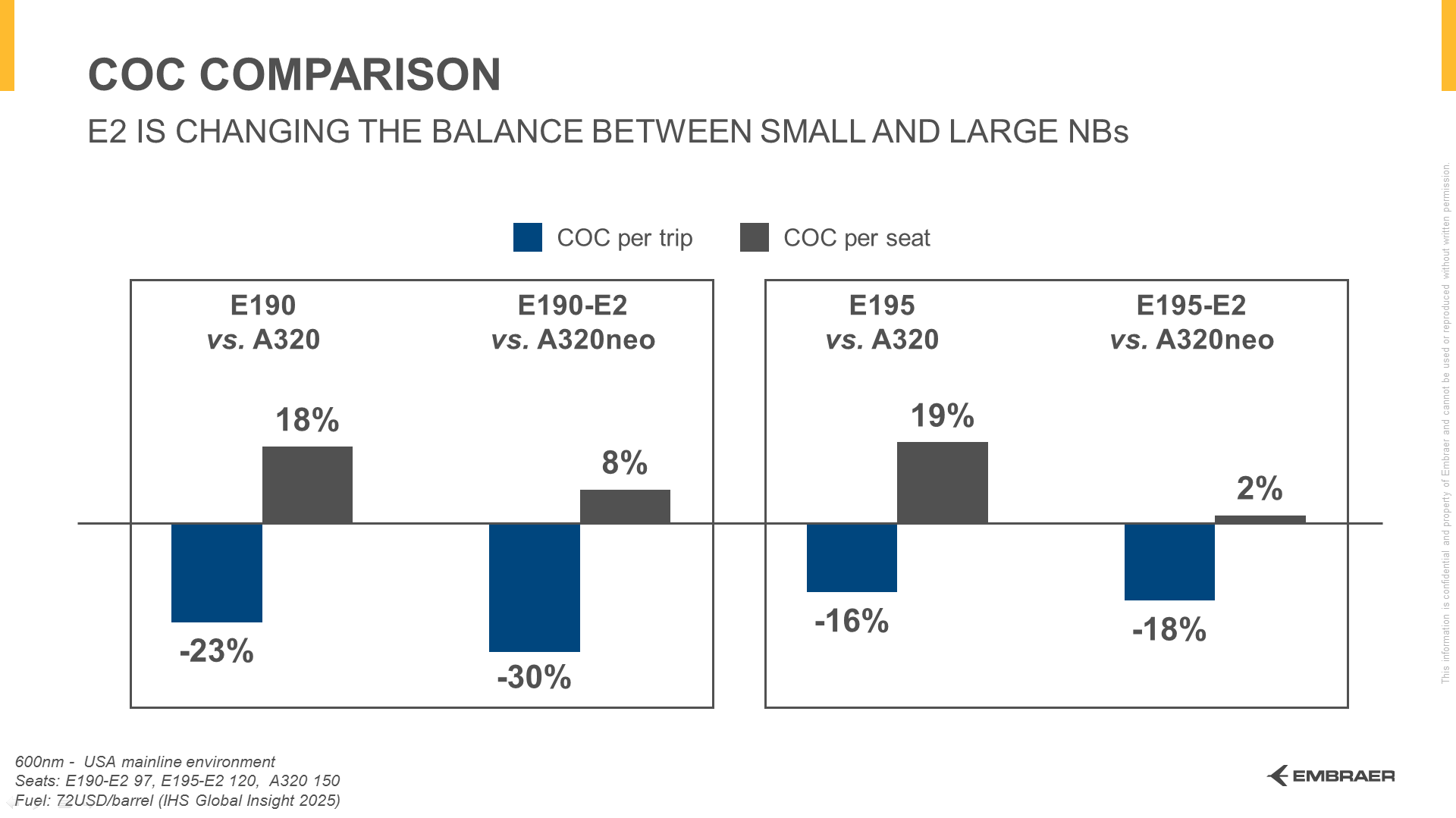

At Embraer, with the E2 we are changing the status quo in terms of cost comparisons, reducing the cost gap compared to larger NBs. We went far beyond a simple re-engine exercise, optimising each variant in order to offer the most efficient single-aisle family.

While the E195 offers a 16% COC advantage over the A320ceo on a per trip basis, the E195-E2 is 18% more efficient than the A320neo. The largest E2 variant can now boast a similar cost per seat compared to the A320neo, while the current E195 has a 20% higher cost per seat than the A320ceo.

Coupled with the extended range and operating performance, the economics of the E2 will drive the deployment of an aircraft capable to extract the most value from low-to-mid-density markets to remain sustainable in the long run, instead of upgauging across the board.

The E2, with its rich hunting grounds, will form an ever more integral part of the global air transport eco system.

Written by Victor Viera and Maximo Gainza