European airlines are facing challenges on several fronts — including (but not limited to) political uncertainties, fierce competition, higher input costs, and an ever more difficult yield environment. All of this is setting the stage for an uncertain future for airlines and it has catalyzed a scramble to explore new avenues for survival.

In today’s highly competitive marketplace, the dynamic is continuously changing. The landscape of the airline industry can no longer be defined by the dichotomy between Full Service Carriers/Regionals and Low Cost Carriers. A targeting convergence can be perceived in the two main strategies. Evolving airline business models as well as product offerings are bringing more value to investors in a range of ways.

Resilient strategies and a more nuanced competitive positioning will be increasingly important. Some airlines are already leaving no stone unturned in trying to find new sources of revenue and cost savings. Nearly every major airline has undertaken structural reforms in order to adapt to the new landscape, resulting in the convergence of business models.

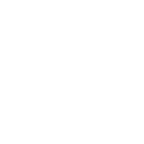

The formerly separate business models or unique selling points (USPs) of FSCs and LCCs have converged in recent years – even swapped in some cases –, partly in response to the competitive pressure between the two.

Until not so many years ago, it was almost unthinkable for FSCs to be charging for on-board meals and drinks, checked luggage, seat selection, and so on. FSC’s basic economy fare, which strips out amenities like checked baggage and advance seat assignments, is now also a competitive tool against discounters. Some, for example, have a full-service operation, followed by a lower-cost division operating for the mainline; as well as another more supranational dedicated LCC division, and even a separate charter/leisure-focused division complemented by a regional franchise below that.

Indeed, the strategy of adopting multiple brands and business models has proven to be an actual alternative to serve all passenger profiles. This structure is broadly true of the largest FSC groups in Europe: IAG, Air France-KLM and Lufthansa.

Since the creation of the Common Market for air services in 1997, low-cost operations emerged throughout the region, locating their operations on the basis of market opportunities rather than in a fixed base country. The original no-frills U.S. model, firstly developed by Pacific Southwest and subsequently implemented by Southwest Airlines, has been adapted, modified and even radically changed in Europe.

The region’s LCCs adopted new management practices, redefined their market position and created unique offerings in order to generate real strategic value for investors.

LCCs were true to their “no frills” mantra, with few ancillary products offered that could enhance one’s journey. Now, what is possible is continuously being redefined. Like a traditional Full-Service Carrier, the long-haul LCC sector with the deployment of wide-body aircraft is no longer experimental and is becoming more mainstream. One of the last great taboos between FSCs and LCCs may be challenged in the near future: co-operation between the two, in the form of code-sharing, feeding each other’s networks, mutually improving each other’s connectivity. Some LCCs are also making use of non-traditional strategies, such as multi-fleet type, loyalty programs and sales through global distribution systems to premium customers.

The line between friend and foe is undoubtedly blurring, but there remain some key fundamental differences – for now – between FSCs and LCCs:

-How to guarantee commitment from a supranational LCC in feeding the network of a national FSC?

-How to harmonize a long-haul business product with that of an LCC on the shorter leg of the journey?

-Assuming FSCs would migrate to long-haul operations only, from where would they source their crew?

-How viable are narrow-body aircraft (especially larger ones) as hub feeders?

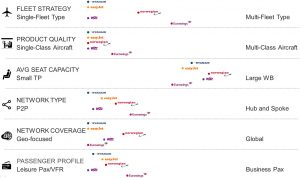

Selected LCCs Product and Service Positioning

Within such a market environment, it is likely that new business models, be it complete innovations or the creative combination of existing elements, can flourish and enhance overall industry efficiency. The hybridization of business models implies that airlines now target a broader customer spectrum with a widened competitive scope. Within the structurally changing environment this new dynamics require multi-class services and multiple types of aircraft (rather than the one-size-fits-all approach) to serve different missions are key facilitators to go beyond the minimum operational and financial performance required.

Written by: Victor Vieira